On July 1, Florida’s second major property insurance reform law went into effect, complimenting 2019’s HB 7065, the original AOB reform law. This means more hurdles to clear with insurers as they continue their clamp-down on AOB claims for mitigation companies, GCs, roofers, electricians, and plumbers.

While the AOB requirements will remain the same, the SB76 Property Package legislation adds additional obstacles for AOBs including:

1. Preventing contractors from soliciting homeowners directly.

2. Reducing the time to file claims from three to two years, with an additional year to file supplemental claims.

3. Adding new requirements and post-loss conditions for insureds that can impact the AOB claim.

Get assistance for your AOB claims.

Insurance Litigation Group has been representing AOBs throughout Florida for almost two decades and understands the tactics property insurance companies use. Our experienced and aggressive insurance litigation attorneys can help you get paid fairly for your time and labor on the front end at no charge — by reviewing your claims processes and contracts, or in the event an AOB claim has been denied or underpaid. When the insurance company needs coaxing, our statewide property law experts will be there to help!

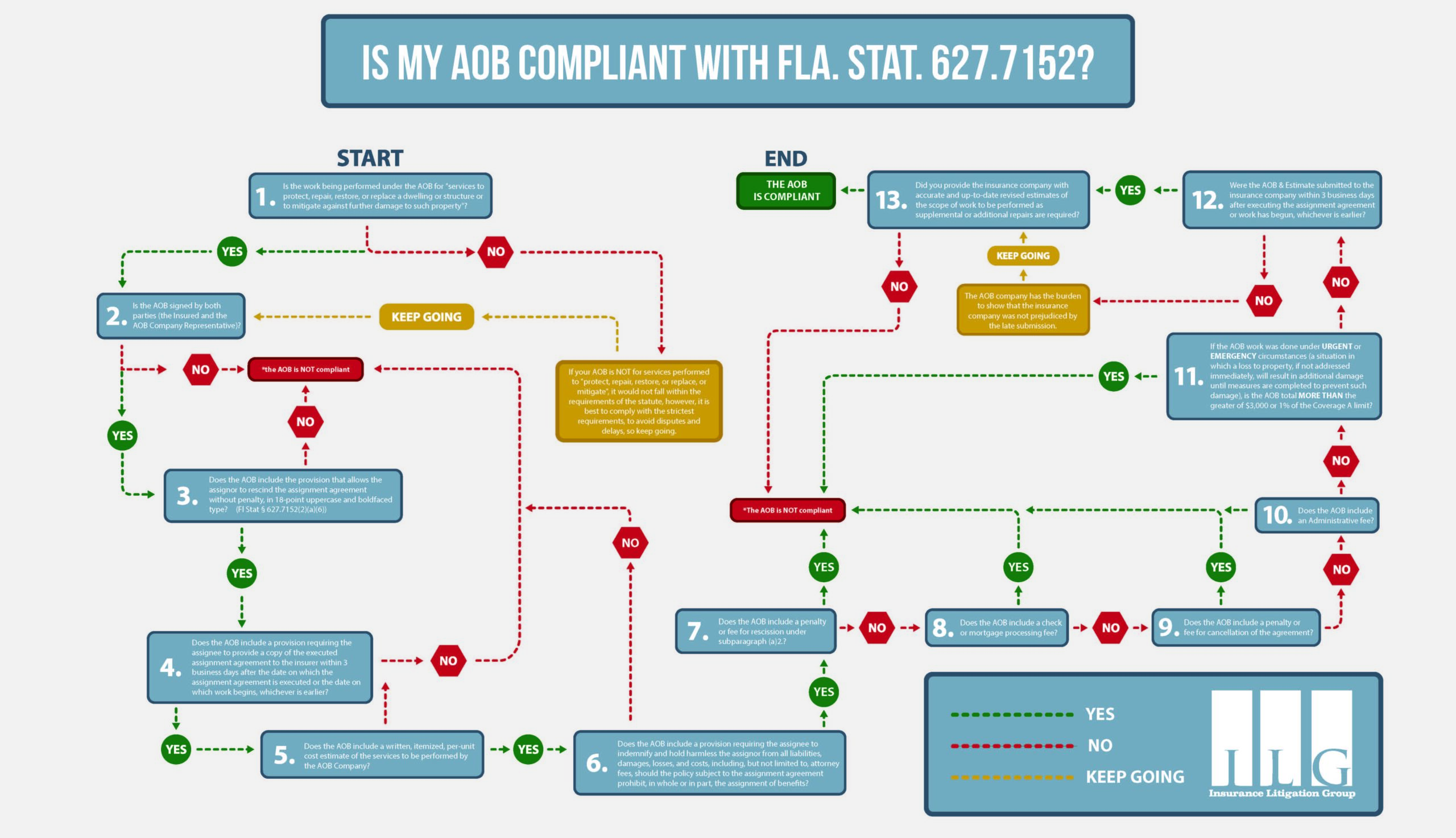

Click below to take a look at our infographic below, IS MY AOB COMPLIANT, or give us a call at (786) 529-0090. We have Florida covered, with offices in the Florida Panhandle, South Florida, Central Florida, and the Treasure Coast.

Give us a call today or visit www.ilgpa.com